This article is for fleet managers, sustainability managers and zero emission fleet transition specialists who want to learn about:

- Important considerations when planning a fleet transition to electric vehicle technology

- The challenges and risks of a simplistic approach to electrification

- Using fleet data to guide a successful electrification journey and make informed decisions about EVs and charging infrastructure

- Identifying vehicles best suited for electrification and optimising fleet utilisation to reduce total ownership costs and enhance efficiency

- Insights on fleet optimisation that go beyond replacing internal combustion engine vehicles with EVs

The Risk of a Simplistic Approach to Fleet Electrification

The goal to transition to zero emission vehicles is a challenge for many fleet and sustainability managers of transit fleets, school buses, government fleets, utility, logistics and even corporate fleets.

Mission critical fleets with fixed routes such as transit can experience significant variations of duty requirements each day based on weather conditions, passenger loading, battery state of health and topography of a specific route. Many other fleets with variable routes that are not predictable also have challenges identifying the right vehicle and charging infrastructure pairing to optimize the transition.

When adding the very first electric vehicles (EVs) into the fleet, it is not uncommon for a fleet to take a simple and straightforward approach and choose a few vehicles that could be good replacements based on simple calculations or just trial and error. Each combustion engine vehicle is directly replaced with an electric vehicle consisting of the most battery capacity available for the longest range, starting with the vehicles that have the least distance traveled, and one charger is purchased and installed for each vehicle, with the fastest charging rate that the budget can afford.

Although this simplistic strategy can still help a fleet learn about electric vehicles to inform future procurements, it can be an inefficient approach and be detrimental when the numbers of EVs in the fleet starts to rise. This can result in significantly higher costs than necessary, and can also lead to underutilised assets or worse – vehicles not being able to meet their route requirements on extreme days. While this may not be a big issue for the first few vehicles, the long-term impact can not only cost more than needed, it can also have a negative effect on the organization’s enthusiasm and willingness to continue moving toward 100% decarbonisation.

This approach not only impacts the cost of vehicles, charging hardware, and infrastructure installation, it can also impact overall energy costs when charging the fleet, causing power demand and utility charges to be higher than needed.

The transition to an electric fleet is also an opportunity to optimise the fleet and take a comprehensive look at how operations can be tweaked for greater efficiency and cost-effectiveness. With an all-encompassing approach, the result is not only lower costs, but can also lead to a faster path to reduce emissions. When you look at the system as a whole and take the data into account, alternate pathways may be uncovered that do not just rely on buying more vehicles and chargers.

Fleet Data: The Key to Successful Decarbonisation

Embarking on fleet electrification requires careful consideration of key factors, including vehicle range, charging time, depot or office spatial limitations, and the impact of charging patterns on energy infrastructure required and long term energy costs. This process should start with a comprehensive analysis, gathering detailed fleet data to inform decisions. Historical usage data is crucial in developing an optimal fleet profile, considering both public and depot charging solutions.

Identifying the right electric vehicles and chargers for a large complex fleet involves analyzing each vehicle’s daily travel distance, usage patterns, payload, local climatic variations, potential for regenerative braking, terrain challenges, ability to use public charging, stop frequency, and more. Within this context, a data-driven approach enables optimised vehicle and charger selection, leading to a lower risk and lower cost rollout of EVs and chargers.

EVenergi has extensive experience working with fleets to review their usage patterns and determine how operations can be optimised. We work with fleets with varying levels of data quality and have found that when combining the review of vehicle telemetry data with fuel and distance traveled, you can paint an incredibly accurate picture which will provide a blueprint for the vehicles and chargers required.

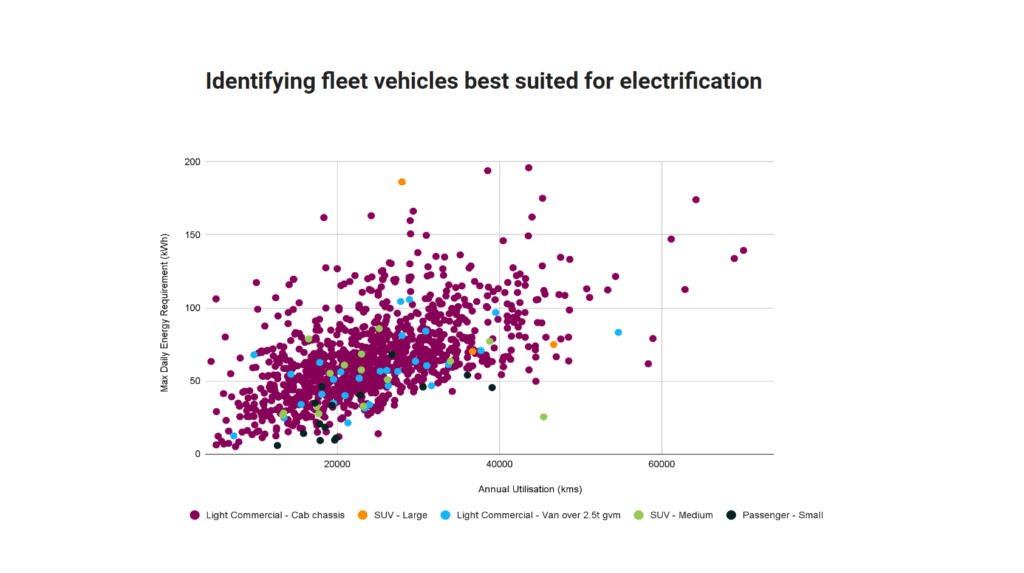

With the right fleet data in hand, an analysis comparing vehicles based on their maximum daily energy requirements and annual utilisation reveals important insights on which vehicles are best suited for electrification.

The scatter plot above represents a fleet of vehicles, with each dot symbolising a single vehicle based on its maximum daily energy needs and the distance it travels annually. This example contains a mixed vehicle fleet consisting of multiple vehicle types with variable routes.

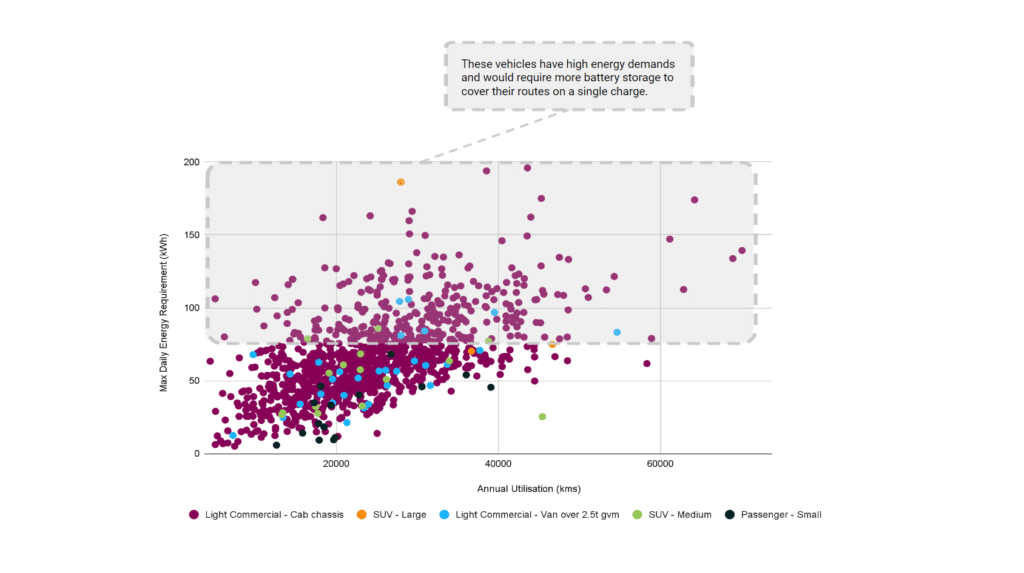

The visualization makes it easy to first carve out the vehicles with the highest maximum daily energy requirements, which can be due to long range distances and/or more demanding routes. These vehicles would need more battery storage on board than offered by currently available vehicles in order to operate every daily schedule on a single charge. The number of vehicles in this area will decrease as batteries continue to become more energy dense and cost effective, and electric vehicles can hold more energy on board.

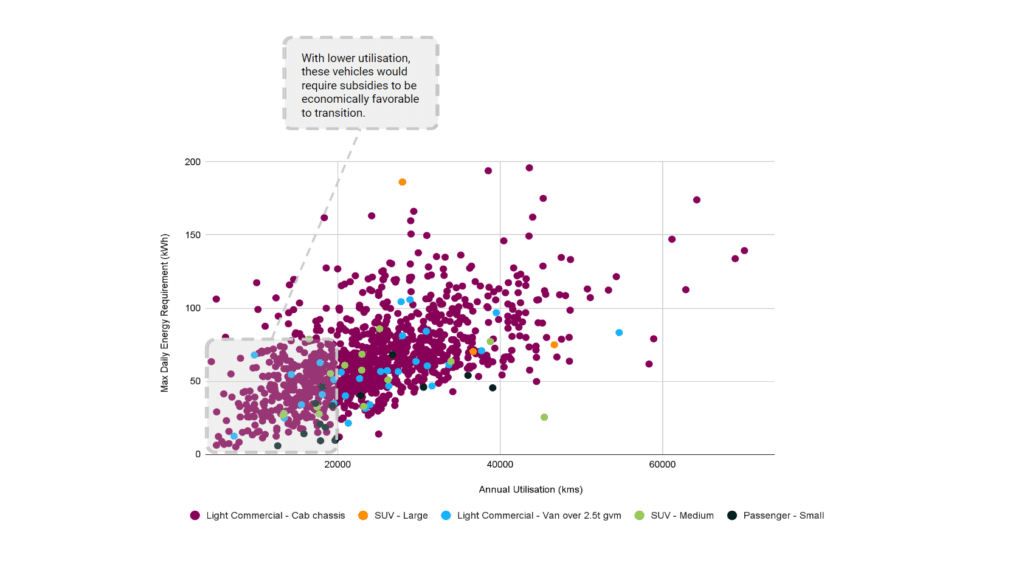

The utilisation vs. energy required analysis also helps identify which vehicles could be replaced with currently available EVs, but would require economic subsidies or cost reductions to have a lower total cost of ownership than an internal combustion engine (ICE) vehicle.

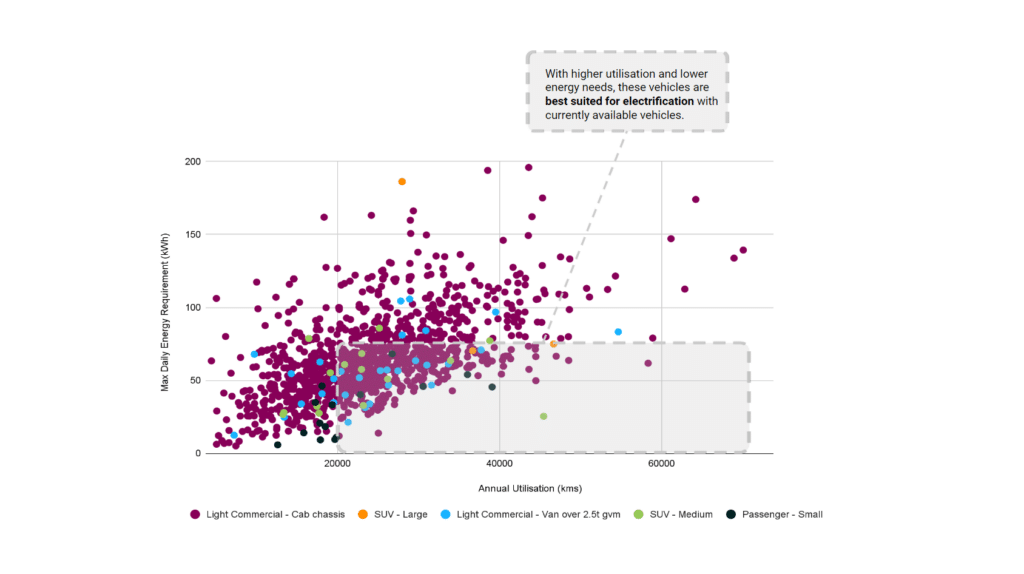

In the shaded area of the final chart above you can see the vehicles that are best suited for electrification now based on the technology available in the market. These vehicles have higher annual utilisation and lower maximum daily energy requirements.

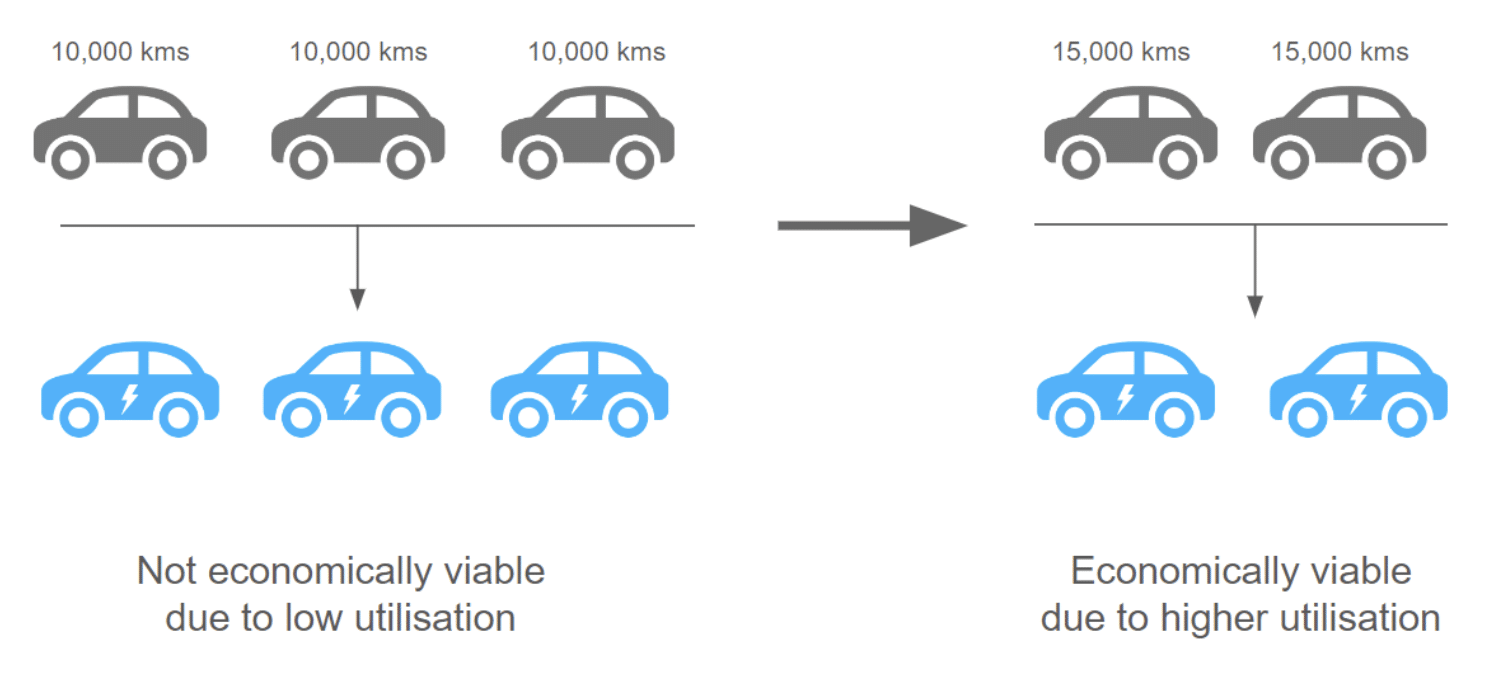

This type of review can not only help you identify which vehicles are most suited to be transitioned to electric, but also can help you identify underutilised vehicles within the fleet and understand the characteristics of their utilisation. With this information, you can optimise your fleet by uncovering insights such as the ability to consolidate 3 low utilisation vehicles into 2 vehicles with higher utilisation and more favorable economics.

Beyond Buying Vehicles: Fleet Optimisation Insights Uncovered

The collection of this comprehensive fleet data offers more than just insights into vehicle and charger selection. It also opens avenues for rethinking vehicle deployment and route optimisation. Analysis might reveal that certain vehicles are versatile enough to serve multiple functions, or that adjusting specific routes in fixed route fleets could yield better efficiency.

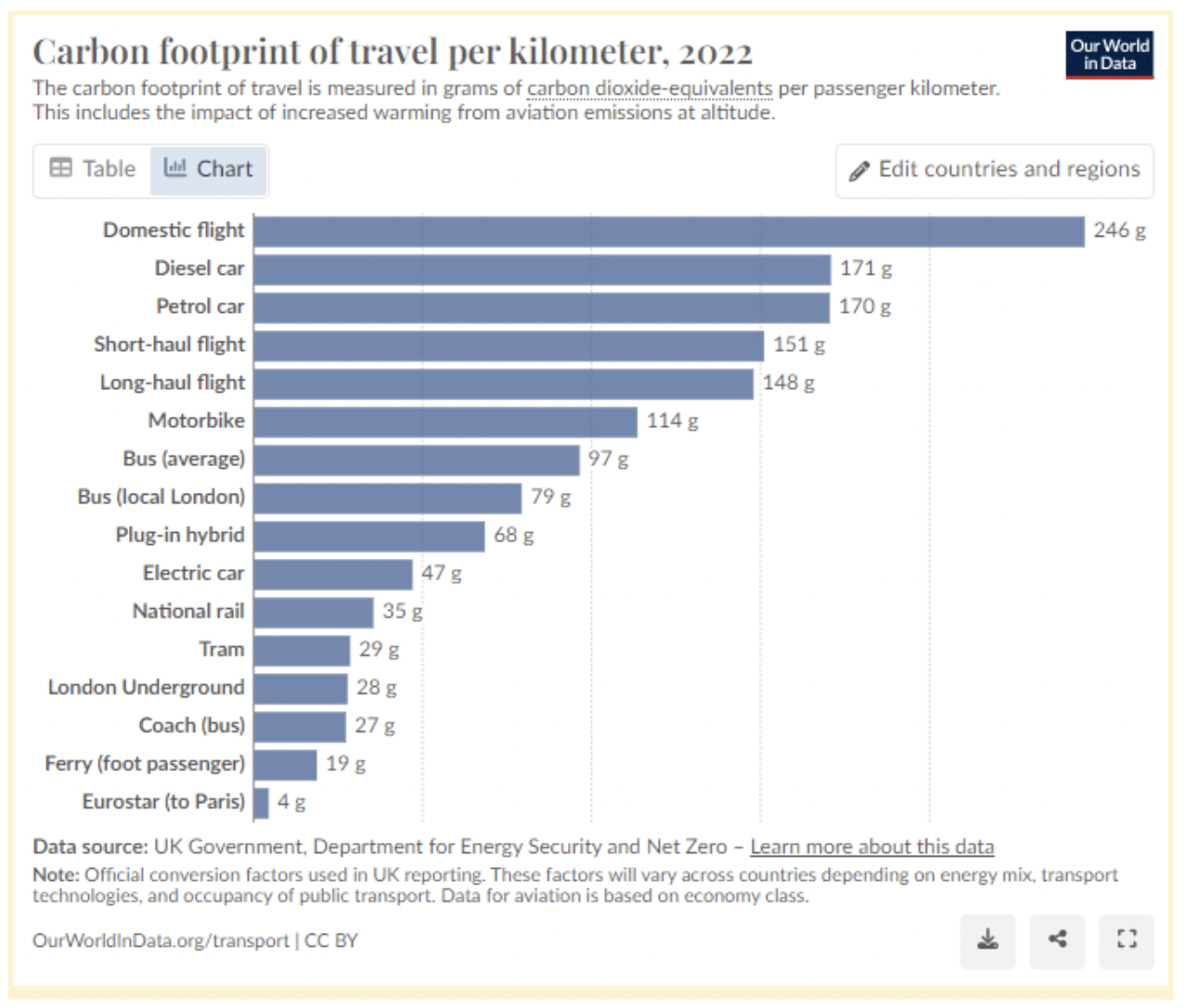

Additionally, the fleet data can inform initiatives to encourage behavioral changes, such as promoting modal shifts in transportation use. This approach involves replacing car trips with lower-emission alternatives whenever possible, which could include using public transportation, cycling, walking, carpooling, or teleconferencing for meetings. The exact reduction in CO2 emissions depends on the mode switched to; while using public transportation can reduce emissions by 50% or more compared to driving alone, replacing a car trip with a bicycle ride or eliminating the trip due to virtual meetings can eliminate emissions entirely.

While not all vehicles in the fleet may be ready for swapping out with an EV just yet, shifting the rest of the ICE fleet to more efficient vehicles such as hybrids in the meantime can also make a significant impact on lowering overall fleet emissions while EV technology continues to improve and prices reach parity with combustion engine vehicles.

In addition, as most fleet managers are well aware, driving efficiency has a significant impact on fuel consumption and CO2 emissions. Efforts such as training drivers on fuel-saving techniques like avoiding rapid acceleration and braking, maintaining proper tire pressure, and optimizing route planning can improve fuel efficiency by as much as 30%.

—————–

Integrating data into the planning process can allow fleet managers to uncover ways to achieve more with fewer resources. It can mark a strategic shift from a one-to-one replacement of ICE vehicles with electric ones to considering if fewer EVs can meet the fleet’s demands.

Decarbonisation and the EV transition are often discussed interchangeably, yet it’s crucial to understand that fleet electrification is just one pathway towards the broader goal of decarbonisation; other viable options exist as well. Vehicles, including electric ones, have an inherent CO2 footprint from production, as do electricity and hydrogen when generated from non-renewable sources. Therefore, one of the most impactful steps towards decarbonising a fleet lies not just in switching fuel types but also in reducing the total amount of vehicles and chargers needed and maximizing the usage of those that remain.

By analyzing usage patterns and operational needs, it’s possible to not only reduce the number of vehicles but also enhance overall fleet performance and uncover a faster path to zero emissions. We have also found that an initial plan, even with lower quality fleet data, can help to justify the long term business case for telematics.

Each fleet is different and there is not one single solution that is perfect for every fleet –this comprehensive approach is based on establishing a framework to look at the fleet with the right parameters, enabling the discovery of valuable insights that can help fleets reach their emissions reduction goals faster at a lower cost, and resulting in a more efficient system.